Research

Regulatory Hurdles and Costly Delay in Housing Development (job market paper)

Abstract: This paper quantifies the supply effects of discretionary permit review, a common but understudied regulatory friction that delays and adds uncertainty to housing development. Using the universe of permit applications in Seattle, Washington, during a period when a unit count threshold for undergoing discretionary permit review was in place, I show that undergoing discretionary review increased permit review time by 4 to 5 months, and that developers reduced unit counts and increased average unit size in order to avoid discretionary review. I then propose a novel extension of prevailing housing production models to multifamily developments that accounts for both the intensive and extensive margins of development. Using data that is freely and publicly available in most jurisdictions, I estimate the model and find that removing discretionary permit review would have increased the number of new units constructed by 5.5% while reducing the average size of new developments by nearly 2%. The estimated change comes largely from the intensive margin, as, in expectation, only two additional parcels would be redeveloped absent discretionary review.

The Effects of Residential Landlord-Tenant Laws: New Evidence from Canadian Reforms using Census Data

(with Dylan R. Clarke)

Journal of Urban Economics 140 (March 2024): 103631

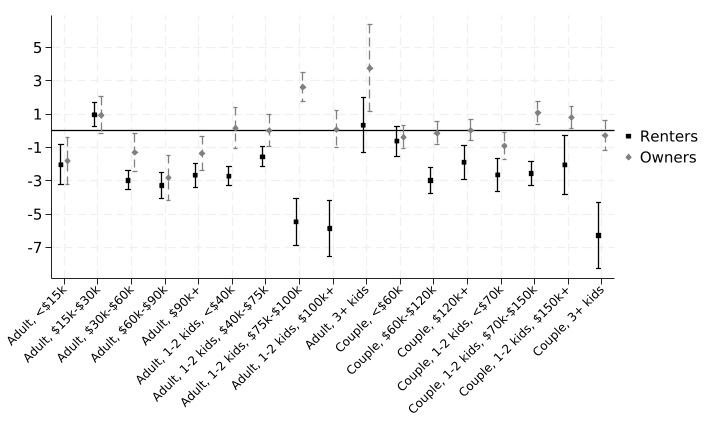

Abstract: We study the consequences of landlord–tenant laws on quality and prices in the rental housing market. We use the staggered introduction of Canadian Residential Tenancy Acts to study the consequences of a landlord–tenant reform that reduced tenants’ litigation costs and improved their bargaining power through mandatory contractual terms. To do so, we employ the difference-in-differences approach to estimate the average treatment effect on a repeated-cross section of households, controlling for income and family structure in five cities. The estimates imply that the reform led to a decline of 2.2 percentage points in the probability of a major defect, with no measurable effect on rent prices or homeownership rates. The average treatment effects are concentrated within families with children, who face greater costs to moving in response to property damage. The results are consistent with a stylized model in which a reduction in litigation costs allows the tenant to more cheaply recover on damages when moving costs are high, with second-generation rent controls limiting increases in rent prices charged by the landlord.

The Impact of Distance in Retail Markets

(With Jean-François Houde, Peter Newberry, and Katja Seim)

AEA Papers and Proceedings 113: 229-233

Abstract: We examine the demand-side implications of Amazon's distribution and logistics investments. Our results indicate that online demand—transactions at Amazon and its competitors—does not respond to the consumer's proximity to Amazon's upstream fulfillment distribution facilities, suggesting that their densification did not differentially improve local shipping times and on-time delivery. Instead, we find that investments in last-mile delivery facilities and services allow the company to improve shipping times more directly in the urban markets served by these facilities, simultaneously increasing demand through the rollout of same-day service options and reducing the visits to traditional brick-and-mortar retail.

The Effect of Regulatory Oversight on Nonbank Mortgage Subsidiaries

(with Eliana Balla, Raymond Brastow, and Morgan Rose)

Journal of Real Estate Finance and Economics 68, no. 3 (April 2024): 523-575

Abstract: In 2009, the Federal Reserve subjected nonbank mortgage-originating subsidiaries of bank holding companies (BHCs), but not independent nonbank (INB) mortgage originators, to consumer compliance supervision. We examine the effects of this regulatory change on the pricing and performance of nonbank originations using a sample of conventional, first-lien, amortizing mortgages originated between 2000 and 2015. We find that subsidiary nonbank (SNB) loans, which had a higher probability of default than INB mortgages prior to the policy change, had a lower probability of default following the change. In addition, we identify small but statistically significant decreases in loan interest rates and loan-to-value ratios for SNB mortgages relative to INB mortgages. When we split our sample into prime and subprime mortgages, we find those effects hold for prime mortgages. For subprime mortgages, after the policy change SNB originations had higher interest rates and lower LTV ratios than INB mortgages, with only weakly significant differences in probabilities of default. The findings are robust to several potential confounding effects, including those due to firm entries and exits. Our findings are consistent with BHCs reducing risk shifting in mortgage lending across subsidiaries following their heightened regulatory scrutiny.

Hidden Biases: Selective Advertising in the Rental Housing Market (with Lu Han and Christopher Timmins)

Work in Progress

Abstract: While audit and correspondence studies have documented persistent racial discrimination in rental housing, these methods are not designed to capture subtler forms of bias that can occur without renters ever realizing it. This paper examines one such overlooked practice: selective unadvertising, where landlords withhold available units from online listings and instead fill them through informal channels that disproportionately benefit white renters. We introduce a novel, data-driven approach that links unit-level rental listings from a major online platform with detailed tenant turnover records across 27 U.S. metro areas. By comparing the racial composition of occupants in listed versus “hidden” units and controlling for alternative factors that might account for racial sorting, we assess the extent of discrimination through selective advertising. We find that Black renters are more likely to occupy listed units than comparable white renters, with disparities especially pronounced in neighborhoods offering better amenities, environmental quality, and upward mobility. Moreover, the burden of selective advertising falls disproportionately on lower-income renters and families with children. Together, these findings reveal how seemingly invisible listing practices can reinforce residential segregation and unequal access to neighborhood resources by shaping how information is supplied.

Much ADU about Something? Evidence from a Recent Reform (with Anya Tarascina)

Work in Progress

Abstract: In response to high and rising housing costs exacerbated by historically low levels of new housing construction, many U.S. cities have enacted reforms to encourage accessory dwelling unit (ADU) development of on lots otherwise zoned for single-family development. These policies aim to increase housing density without requiring broader zoning changes or more disruptive development. This paper focuses on a 2019 reform in Seattle that eased ADU restrictions. First, we consider the impact of this reform on homeowners’ decisions to build ADUs. We then examine the effect of the policy and new ADU constructions on property values. We find that ADU permit applications surged following the reform. Using a repeat-sales framework, we estimate that constructing an ADU increased property values by 13\%. Additionally, we provide evidence that the option value of ADU construction increased home values in all ADU-eligible lots, with greater appreciation observed for properties with lower initial lot coverage ratios. Our findings inform ongoing debates on urban residential land use policy.